You do not want to hear the noise my district commisioner and treasurer would make if they heard that I was giving advice on accounts and yet here I go. The absolute worst bit about Girlguiding, the thing that’s driven me out of Rangers!

If you do Module 4 of your ALQ, you have to either do your unit accounts for a term or budget for an event. My experience is that there’s no guidance or support for this and you’re just expected to know how to do the accounts and unless you’re handling this sort of thing in your non-Girlguiding life, you’re not going to know where to start.

I do two sets of accounts because I find the petty cash far more bewildering than the bank account. We’re going to start with the cash. I have here a template you can use – Girlguiding also have one but mine is simpler and if you’re googling how to do it, it’ll probably work better for you.

The Internet’s Brown Owl’s Really Basic Simple Accounts Template

Cash

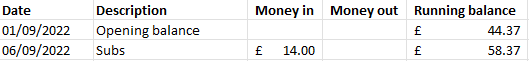

Ok. You’re going to need a spreadsheet, or some squared paper and you’re going to create some columns. Girlguiding accounts run September to August. The first column is the date. The second column is the description. The third column is the amount of money coming in and the fourth column is the amount of money going out. Then the fifth column is a running balance.

In the first line, you write “Opening balance”. If you’ve been handed a cash tin with money in, count it and write that down in your running balance column as the money in the account on September 1st. How it got there is up to whoever did the accounts for the previous years, so you don’t have to worry about it. In this demo version, I received a tin with £44.37 in there.

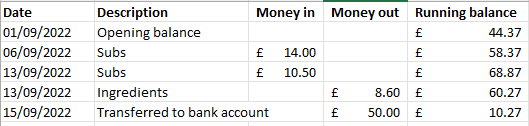

Whenever money goes in or out, write it on the sheet. For example, maybe your first meeting of the year is September 6th. Write that down, write “subs” in the description column and write in the “money in” column how much money you were handed. This is literally just the ones who bring in their coins every week. Anyone who’s paying by bank transfer into your bank account goes on your other set of accounts. I have six girls at the moment and four of them pay £3.50 cash each week, so on September 6th, I received £14. As well as writing that £14 in my money in column, I add it to my running balance in the fith column, which now reads £58.37.

Next week I receive subs from three girls because one is away (she will have to pay for that week later on, they still have to pay even when they’re no-shows because expenses don’t vanish). That means I add £10.50 to my money in column and to my running balance. But we’re also cooking today so I’ve spent £8.60 on ingredients. I write that in its own line, add it to the “money out” column and remove it from my running balance column.

You see? Just keep doing that until you reach August 31st, when you can write “Closing balance” in your description and leave the money in/money out columns empty. Count your cash every now and then to make sure it matches your running balance but if you’re doing this right, it should always match.

If you find the cash piling up, take it to the bank and pop it into your bank account. Several reasons: the money is safer in a bank account than a pile of coins is in your house; bank accounts are so much more straightfoward than counting physical money, your big payments are going to come out of the bank and you want the money in there to be able to do it. You’ll need to keep a certain amount of cash on hand – parents will give notes and want change, your claims will always be in awkward little amounts and you’ll want to hand over expenses to people as you go rather than doing bank transfers of cheques but you don’t need a fortune in cash in your tin.

This goes on the accounts as something like “transferred to bank account” and into the money out column. Make sure you do the reverse when you do the bank account accounts – “transfer from petty cash”, money in.

But that’s not all. You have to keep all your receipts from your claims. I would create another column called something like “reference” and I’d start my first receipt as reference 001. Then I’d write 001 at the top of my receipt and the date claimed. Then when anyone’s checking your accounts, they can match the receipts with the line on your accounts and make sure that’s correct. If you’ve bought a mix of Guiding stuff and personal stuff – for example, you’ve bought the cookie ingredients while doing your weekly shop – you can highlight the Guiding stuff or cross out your own stuff or otherwise make it clear that you’re only claiming certain items. Then I’d count up how much money that claim comes to and write that in nice big obvious letters – I like a purple or green pen for marking up this sort of thing personally. I’ve spent £35 on shopping and £8.60 of that is ingredients, so along the top my receipt has handwritten “001, £8.60, claimed 13/09/22”.

Then, because I helped with the accounts at work, I get a pile of paper and staple all my receipts to them – not all of them in one fat pile but you cover the page so all receipts are visible and when the page is full, you move onto another. This is entirely optional but it makes it easier for whoever verifies them.

The difficulty with accounts comes when you don’t keep them up to date. You’ll do fine if you write it all down every week as it comes and goes but if you leave it until August, you’ll have a ton of trouble figuring it out and if you let a few years pile up, you’re lost.

Bank account

Basically, you’re doing exactly the same except you’re not going to be physically counting cash. Your opening balance is how much is in the bank on 1st September and there will be an entry on your bank statement for everything that goes in and out. Make sure you’ve got something to back them up – I keep copies of cheques but I know people generally don’t bother. Label your receipts again like you did with your cash but perhaps use a different reference system (201, 202, 203… etc, or B001, B002… or just whatever you want so that you can instantly see whether a receipt belongs to cash or the bank). You won’t need to periodically re-count your cash because every month you’ll check that your running balance matches what’s on your bank statement and that’s much easier.

Try not to let the money pile up in the bank account either. This is coming from your girls to be spent on their Girlguiding experience so when you’ve paid the rent and the annual subscription, spend the leftovers on them – buy some new equipment or subsidise a day trip or even buy some uniform so you’ve got some to lend out.

Rent and annual subscription

Yes, rent and annual subscription. Rent varies from unit to unit. My Brownies have a special relationship with the church that pre-dates me and means that as long as we turn up to the occasional service or messy church day, we don’t pay rent. The other Brownies that meet in the same room don’t have that relationship and so they do pay rent. We had a Guide unit in the district who rented the Scout hut and their rent was so high that the unit became economically unsustainable and had to close. Our district sets the subs so no one can undercut their rivals but because our rents are all so different, it means some units are permanently in debt and some units are rich.

Annual subscription is the bane of our lives. Every year, Girlguiding will demand a sum of money from every member. That’s every Rainbow, Brownie, Guide, Ranger, Young Leader, adult leader, commissioner, trainer, supporter, treasurer and everyone in the office who keeps the movement running. HQ will set a certain amount and then your region, county, division and district get to add a levy to cover their expenses. So Region will want to cover their members who aren’t attached to units, like all the support folks and they’ll want to boost their funds a little so they’ll add a bit. County want to cover the county team and boost their funds a little bit so they’ll add a bit. And so on.

How this is dealt with varies from unit to unit. In my district, we’re expected to meet annual subscription out of our subs. In other districts, perhaps parents are asked to pay or volunteers are asked to pay so you know there will be a lump sum in February on top of your subs. And yes, as well as your kids, you have to pay for any leaders in your unit. If you work at more than one unit, you’ll have one designated as your main role. For me, that’s Rangers so my Brownies only had to pay for the unit helper in 2022 and like I said, we have a little spare money because we don’t pay rent.

You never know how much annual subscription is going to be and because of the local levies, my estimate may not be anywhere near your estimate, but we were around £33 per member this year. Six Brownies plus unit helper means we had to have £231 in our bank account in February to cover that. Imagine how high annual subscription can get if you’ve got a decent-sized unit! You need to know you’ve got enough money to pay for it, which is why you really need to keep your accounts in order.

Once that horrendous cost is over, if you’re confident you can collect in enough to pay next year’s, you can spend the surplus on your girls.

Audit

You’re supposed to get the accounts checked and signed off by someone before you submit them to your local commissioner. In practice, I’ve never done that because 1) it’s enough of a stress just getting them done in the first place 2) you need to know someone who understands accounts well enough to audit 3) they need to be willing and have the time to do it.

I know some districts pass them around each other to do, so once your accounts are in order in September for the previous year, see if one of your fellow leaders will look them over. Then once they’re signed, you pass them to your local commissioner and you get on with next year’s!

It’s not as hard as it sounds but there’s no support, no teaching and a lot of stress.

What if mine are a mess?

If yours are in as much of a mess as mine were, do the latest year and work backwards. How much is in your account at the end of the year? Ok, that’s a closing balance. Leave a huge gap and write that right at the bottom. Do you have the receipts and evidence to work backwards and upwards to September? Good! If you’re using formulas, that might have broken them but formulas are easier to fix than empty account sheets. Now you’ve got an opening balance and a year’s worth of accounts!

Maybe you can work backwards again to do the previous year? Do your best – recruit a friend or a fellow leader, speak to your local commissioner and try to grab your local treasurer to help out. Treasurers love to help you untangle your money and they know what they’re doing.

If they’re really in that much of a state, at least you’ve got one year and now you can keep them straight going forwards. It’s better than nothing. It’s so much better than nothing.

Good luck

Good luck with your accounts! Have fun! Keep them up to date every week!

Leave a comment